Vancouver, April 28, 2022 – Stellar AfricaGold Inc., (TSX.V: SPX, OTCQB: STLXF, TGAT: 6YP1 and FSX: 6YP1) (“Stellar” or the “Company”) is pleased to announce that it has completed the eleven-trench exploration program at its Namanara Gold Project in southwest Mali and that the project is now ready for a planned 2,500 meter drill program.

Program Highlights

- Eleven mechanized trenches across Zone 3, 4, 5 and 6. All zones anomalous for gold.

- Trench T3-3 4.11 g/t Au over 7.0 meters including 26.60 g/t Au over 1.0 meter

- Trench T4-2 2.90 g/t Au over 16 meters including 6.24 g/t Au over 3 meters; and 2.34 g/t Au over 6 meters including 3.47 g/t Au over 2 meters

- T4 site is a confirmed 300 meters long high-grade gold discovery; the structure that remains open in all directions.

- 2,500 meter Phase 1 drill program planned

About the Namarana Trenching Program.

A total of eleven trenches were cut across the gold bearing structures Zone 3, 4, 5 and 6 identified during the 2021 reconnaissance program which evaluated the artisan mining sites inside the Namarana Permit. Five trenches were cut on site #T4, four trenches on site #T3 and two trenches on site #T6. One trench was attempted on each of site #T5 and #T2 but overburden was greater than three meters which prevented the excavator from reaching the mineralized laterite. All 11 trenches were dug to an average depth of 2,5 meters, mapped and sampled at 1,0-meter intervals for a total of 648 samples collected and 77 standards, duplicates and blanks sent to the lab for assay.

Results Summary

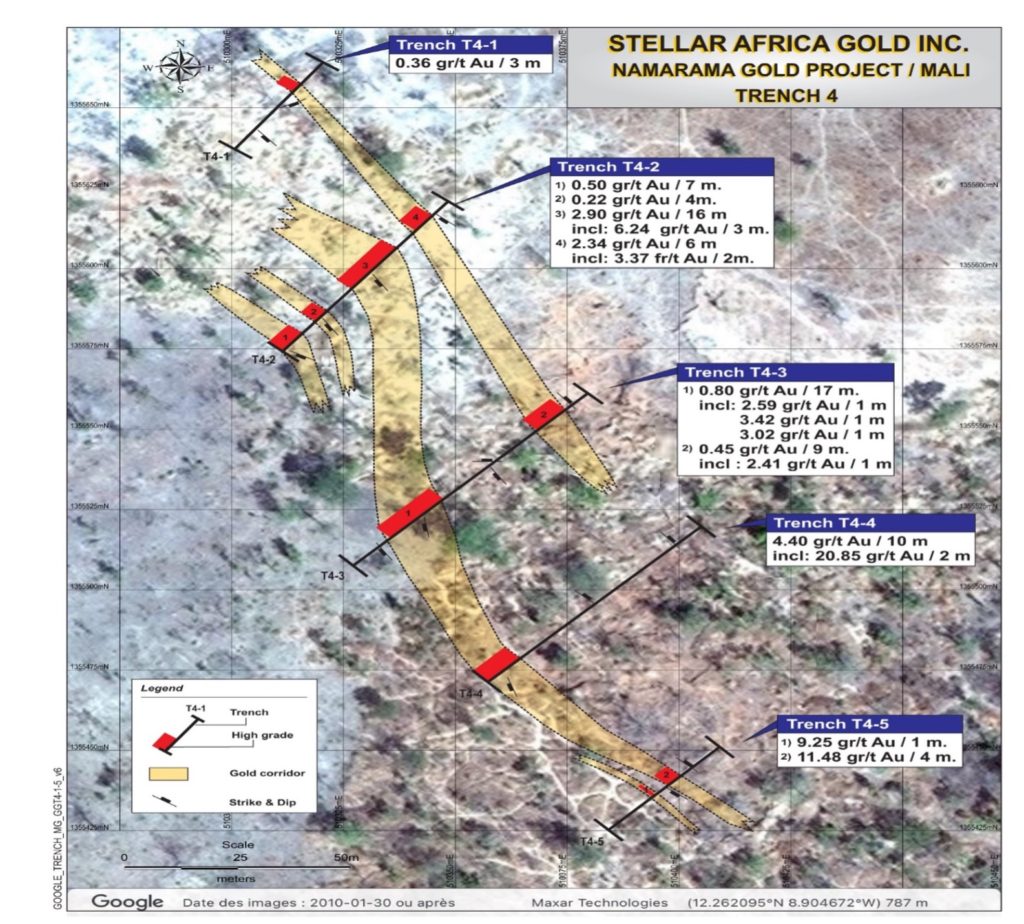

As announced March, 30th 2022, the results from Zone # T4 confirm the discovery of an extensive gold mineralized corridor with high gold grades over substantial width and open in both directions and at depth justifying a drill program. Trenching of T4 to the SE of Trench T4-5 with an impressive 11.48g/t over 4.0 meters was stopped while still in mineralization due to overburden depth to laterite. (see fig.1)

Results T4

Trench 4-1 From meter 22 to 25: 0.36 g /t Au over 3 meters

Trench 4-2 From meter 01 to 07: 0.5 g/t Au over 7 meters

From meter 13 to 16: 0.22 g/t Au over 4 meters

From meter 33 to 49: 2.90 g/t Au over 16 meters including 6.24 g/t Au over 3 meters

From meter 50 to 56: 2.34 g/t Au over 6 meters including 3.47 g/t Au over 2 meters

Trench 4-3 From meter 11 to 28: 0.80 g/t Au over 17 meters including intervals of 2.59 g/t Au over 1.0 meter, 3.42 g/t Au over 1.0 meter and 3.02 g/t Au over 1.0 meter

From meter 59 to 68: 0.45 g/t Au over 9 meter including 2.41 g/t Au over 1.0 meter

Trench 4-4 From meter 01 to 10: 4.40 g/t Au over10.0 meters including 20.85 g/t Au* over 2.0m

*Note: This interval included an assay of > 100 g/t Au which was capped at 30 g/t Au)

Trench 4-5 From metre 14 to 26: 5.14g/t Au over 13.0 meters

Incl: From meter 19 to 23: 11.48g/t Au over 4.0 meters

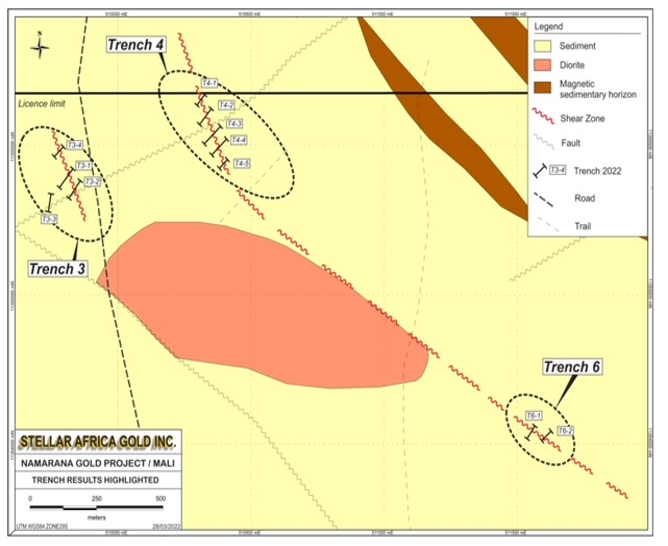

The T3 artisan mine site is located approximately 500 meters West of T4, (See Fig2). Surface observation indicates 2 sets of quartz veins, the first set being oriented NNW-SSE and the second set is oriented E-W. Trenches T3-1,2 and 4 are testing NNW-SSE veins and T3-3 is testing the E-W veins.

The best results were observed in T3-3 cutting across the E-W set of quartz veins, and also across the extensive artisan workings. The surface disturbances by prior excavations at artisan workings had a adverse impact on the trenching continuity and results:

Trench T3-3 From meter 18 to 24: 4.11g/t Au over 7.0 meters including 26.60g/t Au over 1.0 meter

From meter 30 to 32: 0.22g/t Au over 3.0 meters

From meter 45 to 47: 0.56g/t Au over 3.0 meters

Trench T3-3 is oriented NS and was planned to intersect a N700E structure (see fig 2). Additional trenching of this structure was not possible due to the thickness and hardness of lateritic cover. Trenches T3-1, 2 and 4 have intersected sections of anomalous gold contents which will be followed up in future drilling campaigns.

Results T6

The T6 trench site is located 1.4 km SSE of the T4 trench site and show the same lithological and structural characteristics at the T4 trenches (see fig 2).

Trench T6-1 From meter 35 to 37: 0.67 g/t Au over 5.0 meters

Like the trenches at site T3, the surface disturbance from past intense artisan mining activity in the immediate sampling area of trench T6-1 may have an adverse impact on the trenching results. Site T6 will be followed up in future drilling campaigns.

Trench T6-2 From meter 21 to 22: 0.44 g/t Au over 2 meters

Conclusion

The trenching program across some of the Namarana’s priority gold surface occurrences have successfully confirmed a 300-meters long high-grade gold discovery at Site T4. The T-4 mineralized structure remains open in all directions.

Next Steps

The outstanding results of the T4 trenches fully warrant a follow-up RC drilling and the Company is preparing a 2,500 meters Phase 1 campaign to be done towards end of Q2 or beginning of Q3.

Figure 1: Site 4, trenches results

Fig 2 Namarana Local Interpretative Geology

On December 8, 2021, Stellar’s 100% owned Mali subsidiary, Stellar Pacific Mali SARL, was awarded the Namanara Exploration Permit, a 52 Km2 in area located 130 km NW of Bamako in the Kankaba Circle of the Koulikoro district. This award of a full exploration permit followed an earlier short-term ‘look-see’ exploration authorization.

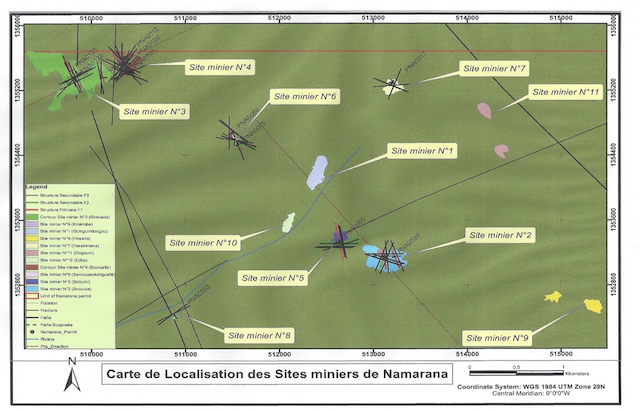

During the term of the ‘look-see’ authorization an extensive reconnaissance program was conducted over the Namarana Permit area. A total of 11 artisan mine sites were visited, mapped and sampled. (see mine sites location fig.3)

Fig 3: Mine sites location

Quartz vein outcropping at Site 4

Quartz vein observed in pit Site 4

Technical and Quality Assurance/Quality Control Notes

Sample collection was done by a team of experienced senior local geologists under the direction of Maurice Giroux, V.P. Exploration and COO of Stellar. The samples were bagged at the sampling site and stored in safe areas until being transported to SGS in Bamako for analysis.

A total of 648 samples were sent to the lab. In addition, for the purpose of quality control, 28 standards, 33 duplicates and 16 blanks samples were added to the batches and are well within the acceptable limit. The blank sample values were all below the detection limit for gold.

About Stellar AfricaGold Inc.

Stellar AfricaGold Inc. is a Canadian precious metal exploration company listed on the TSX Venture Exchange symbol TSX.V: SPX, the OTCQB® Venture Market symbol OTCQB: STLXF, the Tradegate Exchange TGAT: 6YP1 and the Frankfurt Stock Exchange FSX: 6YP1.

The Company maintains offices in Vancouver, BC and in Montreal, QC and has a representative office in Casablanca, Morocco.

Stellar’s principal exploration projects are its gold discovery at the Tichka Est Gold Project in Morocco, and the Namarana gold Project in Mali. The Tichka Est Gold Project is a grouping of seven permits covering an area of 82 km2. The Tichka Est Property lies within the High Atlas Western Domain about 80 km SSW of the city of Marrakech. The area is accessible year-round by road to the village of Analghi located near the mineralized gold zone.

Stellar also holds the Namarana Gold Project in Mali. Namarana is a 52 Km2 that is 100% owned by Stellar’s Mali subsidiary, Stellar Pacific Mali SARL. Namarana is located 130 km SW of Bamako in the Kankaba Circle of the Koulikoro district.

Stellar also holds three permits pending in Côte d’Ivoire.

The technical content of this press release has been reviewed and approved by Gregory P. Isenor, a Qualified Person as defined in NI 43-101.

Stellar’s President J. François Lalonde can be contacted at 514-994-0654 or by email at lalondejf@stellarafricagold.com.

Additional information is available on the Company’s website at www.stellarafricagold.com.

On Behalf of the Board

J. François Lalonde

J. François Lalonde

President & CEO

This release contains certain “forward-looking information” under applicable Canadian securities laws concerning the Arrangement. Forward-looking information reflects the Company’s current internal expectations or beliefs and is based on information currently available to the Company. In some cases forward-looking information can be identified by terminology such as “may”, “will”, “should”, “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “projects”, “potential”, “scheduled”, “forecast”, “budget” or the negative of those terms or other comparable terminology. Many of these assumptions are based on factors and events that are not within the control of the Company, and there is no assurance they will prove to be correct or accurate. Risk factors that could cause actual results to differ materially from those predicted herein include, without limitation: that the business prospects and opportunities of the Company will not proceed as anticipated; changes in the global prices for gold or certain other commodities (such as diesel, aluminum and electricity); changes in U.S. dollar and other currency exchange rates, interest rates or gold lease rates; risks arising from holding derivative instruments; the level of liquidity and capital resources; access to capital markets, financing and interest rates; mining tax regimes; ability to successfully integrate acquired assets; legislative, political or economic developments in the jurisdictions in which the Company carries on business; operating or technical difficulties in connection with mining or development activities; laws and regulations governing the protection of the environment; employee relations; availability and increasing costs associated with mining inputs and labour; the speculative nature of exploration and development; contests over title to properties, particularly title to undeveloped properties; and the risks involved in the exploration, development and mining business. Risks and unknowns inherent in all projects include the inaccuracy of estimated reserves and resources, metallurgical recoveries, capital and operating costs of such projects, and the future prices for the relevant minerals.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.